In the 40 or so years that we've been building homes in the Poconos, there has always been one question that homebuyers ask: “What is this home going to cost me?” While we’ve talked before about the factors that impact the cost of building a home, it’s easy for homeowners to overlook a big factor in the cost of a home - their credit score. That’s why it’s smart to do a credit check before making a move.

In the 40 or so years that we've been building homes in the Poconos, there has always been one question that homebuyers ask: “What is this home going to cost me?” While we’ve talked before about the factors that impact the cost of building a home, it’s easy for homeowners to overlook a big factor in the cost of a home - their credit score. That’s why it’s smart to do a credit check before making a move.

Why Credit Scores Matter

While you’ve probably seen ads on television and online offering to check your credit score, you may wonder if it’s really a big deal or not. Here are a few reasons why your credit score really does matter when you’re planning to buy a house.

- Qualifying for a Loan: Even if you’re making good money, a bad credit score can keep you from qualifying for a loan for the house you want. Lenders look for borrowers who are a good risk.

- Getting Better Rates: Not everyone gets the same rates on a mortgage. The better your credit rating is, the better (lower) rate you may get on your loan. Sometimes the difference may not seem all that significant. But the difference between a 4.45% and a 5.25% loan on a $300,000 house adds up over 30 years. (See below for a visual of how significant that can be)

- Down Payments: Your credit rating can even affect the amount of your required down payment. A poorer credit score may require you to come up with a higher down payment.

- Insurance Costs: Believe it or not, your credit score can even impact the amount you pay for home insurance (and car insurance, too). Better credit scores often mean lower rates on insurance.

- Delays: Something potential homeowners often don't consider is that nothing happens with building a home until the loan is in hand. If you have a particular move-in date in mind, you'll want to make sure your financing is in order so that things aren't held up. Poor credit that holds up a loan also holds up the start of the building of your house.

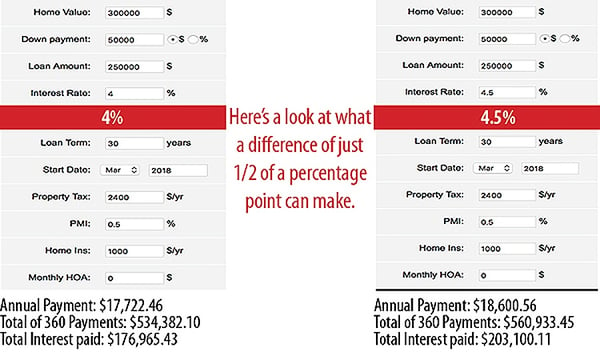

An Example of What a Few Percentage Points Can Mean

Even what appears to be a small difference in interest rates (due to bad credit) can have over the course of your home mortgage loan. This example (from morgagecalculator.org) shows that just one half of a percentage point difference can increase your annual payments by about $880. And over the life of your loan, you could pay about $26,500 more for the exact same house.

Images from mortgagecalculator.org

By the Numbers

The specifics of what makes for a good credit score versus a bad credit score can vary a little bit. Still, the illustration at the top gives a pretty good rule of thumb.

Below 560 = Very Bad

560–620 = Poor

650–699 = Fair

700–749 = Good

750+ = Excellent

How Can You Check Your Credit Score

The three major sources for checking credit scores are Equifax®, Experian®, and TransUnion®. You can request a free copy of your credit report from each of three major reporting agencies once each year at AnnualCreditReport.com. Or call toll-free 1-877-322-8228. Or you might want to check out this helpful article from Forbes on How to Get Your Credit Score Completely Free.

Another option is to shop lenders for mortgage loans. They will actually run credit checks before making a loan. Another advantage to doing this through a reputable lender is that you’ll not only learn your credit score, but you’ll have a better understanding of how much of a loan you’ll qualify for. This will help you in selecting a floor plan based on how much you can afford.

What If You Have a Poor Score?

Just because you have a poor credit score that doesn’t mean you can never buy a home. You can rebuild or establish your credit. We’re homebuilders, not credit experts, but there is a lot of good information available to people who want to begin to improve their credit rating. Educating yourself is a great first step.

A big first step involves understanding how you ended up with a poor credit rating in the first place. The online site credtcards.com has a helpful article that highlights 18 things that hurt your credit score. Some of the information will come as no surprise to you (such as not paying a credit card bill or loan on time). But there are other things that you might not realize can hurt your credit, such as:

- Maxing out your credit card

- Applying for too many cards

- Canceling a credit card (even one on which you owe nothing)

- Not having a credit card

Try to get to the real reasons your credit may have taken a hit. Once you know what caused the problem you’ll be in a better place to fix the situation.

Of course, you’ll need to take action. There is a lot of helpful information available for people who want to improve their credit rating such as this MoneyTalksNews post, Boost Your Credit Score Fast With These 7 Moves.

You won’t repair poor credit overnight, but it’s important to identify the problem and start working on it now so that you’ll put yourself into a position in which your credit rating helps you get the best possible deal on your new home—instead of making it more difficult.